POLICY

Can US-Japan Collaboration Drive Innovative Green Energy Technologies?

August 23, 2024

Take pity on energy policy officials. They are charged with increasing energy production to meet growing global needs and accelerating decarbonization of that energy to reach net zero carbon emissions goals while engineering a “just” transition to that carbon-free future that minimizes harm to consumers and producers of energy, particularly those who are economically disadvantaged. They must do all this while managing unprecedented supply disruptions of energy and related materials caused by the Russian invasion of Ukraine and rising US-China geopolitical tensions.

As two of the most important energy stakeholders in the world, Japan and the US play key roles in managing this set of challenges and have launched a plethora of joint initiatives to address them, including the Competitiveness and Resilience Partnership (2021), the Clean Energy Partnership (2021), the Climate Partnership (2021), the Ministerial-level Clean Energy and Energy Security Initiative (2022), and the Energy Security Dialogue (2022). Most recently on the margins of the Kishida-Biden Summit in April 2024, the two governments launched a new high level dialogue to “maximize synergies” between the US Inflation Reduction Act and Japan’s Green Transformation Promotion Strategy.

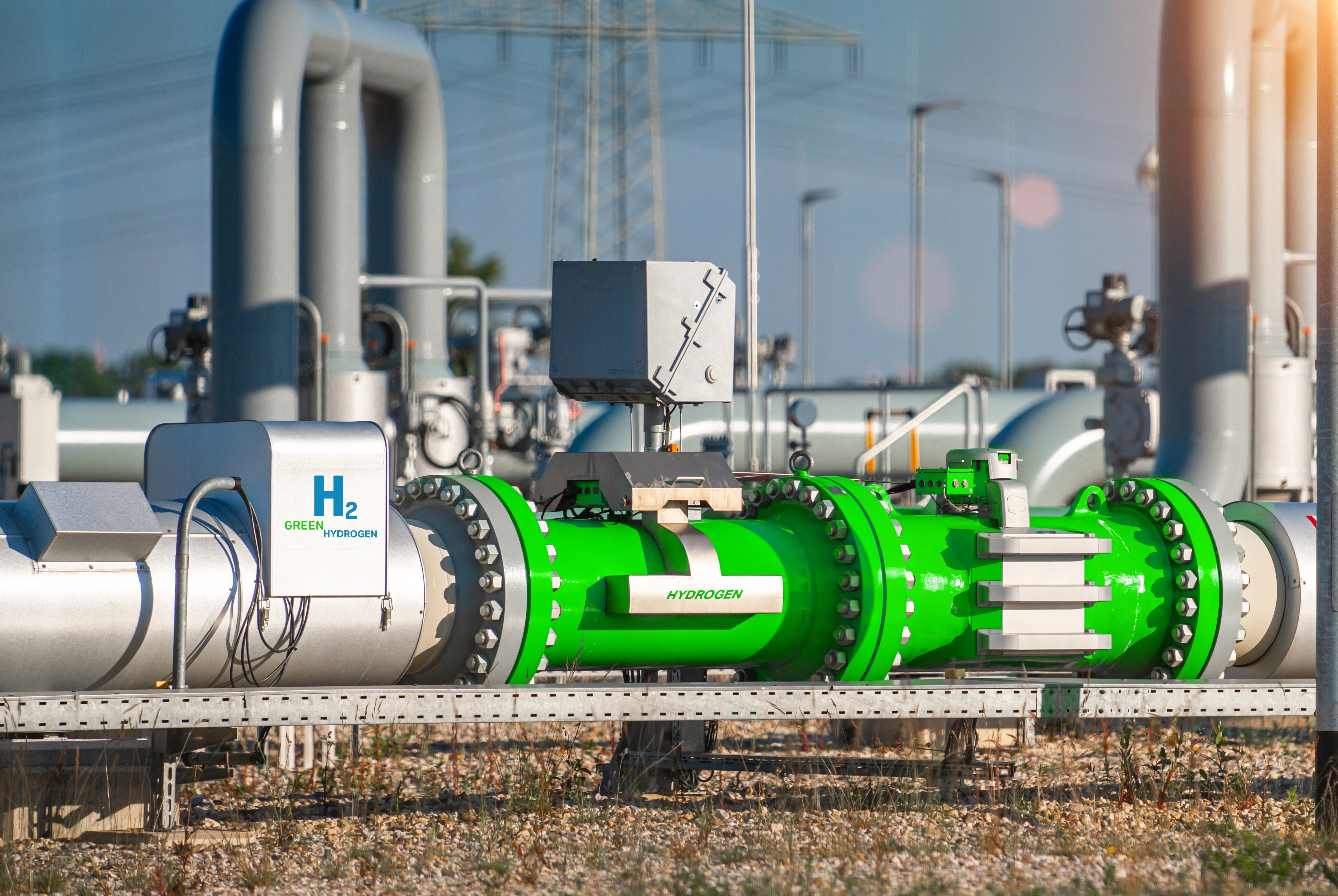

One critical element of this US-Japan cooperation is promoting the development and deployment of cutting-edge new energy technologies in areas such as biofuels, clean hydrogen and ammonia, solar and wind energy technologies, energy efficiency and power grid technologies, carbon capture, utilization and sequestration/carbon recycling, methane abatement and batteries. Since it is rare for large companies to develop and deploy technologies that will disrupt their own business, much of that innovation must come from start-up companies in the US, especially in Silicon Valley, and Japan.

They good news is that there are many energy-related startup companies in the US and Japan working together on energy solutions. These include Bay Area companies such as Green Grid, that is working with Japanese firms on decarbonization solutions, and Principal Power, which is working with Tokyo Gas on an innovative floating offshore wind project in Fukushima. In Japan companies like Helical Fusion and Kyoto Fusioneering (both past “Showcase” winners of the annual US-Japan Innovation Symposium at Stanford) are working on fusion technologies that will revolutionize energy production. Traditional nuclear fission energy is another area of fruitful collaboration – for example, Anthropocene, a Bay Area hybrid think tank/investment fund, sees Japan as key to the future of nuclear power and new startups like ZettaJoule are moving forward with advanced small modular reactor technologies to create safer more efficient nuclear power.

These startups face many challenges in moving technologies to market. To explore what governments can do to promote and facilitate startups working in the energy tech sector, the Japan Society of Northern California hosted a private sector discussion between energy tech venture capitalists and entrepreneurs and delegates of the US-Japan Energy Security Dialogue in at the offices of the law firm Orrick in Palo Alto in October 2023. American and Japanese private sector representatives explained the difficulties entrepreneurs faced and what governments could do to help alleviate those constraints.

One critical element of this US-Japan cooperation is promoting the development and deployment of cutting-edge new energy technologies in areas such as biofuels, clean hydrogen and ammonia, solar and wind energy technologies, energy efficiency and power grid technologies, carbon capture, utilization and sequestration/carbon recycling, methane abatement and batteries. Since it is rare for large companies to develop and deploy technologies that will disrupt their own business, much of that innovation must come from start-up companies in the US, especially in Silicon Valley, and Japan.

They good news is that there are many energy-related startup companies in the US and Japan working together on energy solutions. These include Bay Area companies such as Green Grid, that is working with Japanese firms on decarbonization solutions, and Principal Power, which is working with Tokyo Gas on an innovative floating offshore wind project in Fukushima. In Japan companies like Helical Fusion and Kyoto Fusioneering (both past “Showcase” winners of the annual US-Japan Innovation Symposium at Stanford) are working on fusion technologies that will revolutionize energy production. Traditional nuclear fission energy is another area of fruitful collaboration – for example, Anthropocene, a Bay Area hybrid think tank/investment fund, sees Japan as key to the future of nuclear power and new startups like ZettaJoule are moving forward with advanced small modular reactor technologies to create safer more efficient nuclear power.

These startups face many challenges in moving technologies to market. To explore what governments can do to promote and facilitate startups working in the energy tech sector, the Japan Society of Northern California hosted a private sector discussion between energy tech venture capitalists and entrepreneurs and delegates of the US-Japan Energy Security Dialogue in at the offices of the law firm Orrick in Palo Alto in October 2023. American and Japanese private sector representatives explained the difficulties entrepreneurs faced and what governments could do to help alleviate those constraints.

Funding was of course high on the list. Energy tech is capital-intensive and the Valley of Death – the time it takes to move a proven technology to market before funding runs out – is especially long and arduous in this sector. The Department of Energy’s Loan Programs Office program is ambitious but, with its high minimum investments, was not designed to support startups. The Japanese Green Transformation Fund (GX) has only just been established, but it is not clear how much funding will go to startups. As the two governments look at increasing support for green energy startups, they should consider reciprocal opening of support to companies from both countries which would result in more efficiencies and bigger results.

Mentoring and networking are keys for startups founders who often have little business experience. This can be provided though VC relationships, accelerators, government programs such as Japan’s Star Initiative, or partnerships with large firms. The Japanese Government’s new Japan Innovation Campus in Palo Alto is an example of this kind of support.

Teaming startups up early with larger, more established firms has recently become popular in Japan and Korea as an alternative to the usual Silicon Valley approach which is to scale up first before exiting through an acquisition or IPO. This model might be particularly relevant for a capital-intensive sector like energy.

In most cases the only asset a startup owns is its talent – the engineering and business know how that is essential for success. Both countries have shortages of talent, particularly engineers. The US has traditionally filled that through legal immigration, but that has slowed due to lack of immigration reform. Virtually every tech firm in Silicon Valley has horror stories about losing talent due to visa issues. Japan is moving to open its market for high skilled labor, but from a much lower base than the US. Given America’s strength in software and Japan’s strength in hardware, mutually easing restrictions on movement of tech workers and their families could yield huge results.

Mentoring and networking are keys for startups founders who often have little business experience. This can be provided though VC relationships, accelerators, government programs such as Japan’s Star Initiative, or partnerships with large firms. The Japanese Government’s new Japan Innovation Campus in Palo Alto is an example of this kind of support.

Teaming startups up early with larger, more established firms has recently become popular in Japan and Korea as an alternative to the usual Silicon Valley approach which is to scale up first before exiting through an acquisition or IPO. This model might be particularly relevant for a capital-intensive sector like energy.

In most cases the only asset a startup owns is its talent – the engineering and business know how that is essential for success. Both countries have shortages of talent, particularly engineers. The US has traditionally filled that through legal immigration, but that has slowed due to lack of immigration reform. Virtually every tech firm in Silicon Valley has horror stories about losing talent due to visa issues. Japan is moving to open its market for high skilled labor, but from a much lower base than the US. Given America’s strength in software and Japan’s strength in hardware, mutually easing restrictions on movement of tech workers and their families could yield huge results.

Finally, many observers noted that new massive industrial policy investments mainly support the supply of green energy, but more attention needed to be paid to encouraging demand through government procurement, tax incentives, deregulation, and utility off-take agreements. Finding reliable revenue sources early in the life of a startup is key – many struggle because large business customers and governments tend to favor larger, proven suppliers.

When John Podesta and METI Minister Ken Saito met in April to kick off the new high level energy dialogue, they called for “policies and incentives” that would promote the role of startups as leaders of innovation in the area of clean energy technology.” Hopefully that effort will include a Track 1.5 dialogue that incudes government, big business, startup founders, venture capitalists and academics, along the lines pioneered by the Hoover Center and the Japan Society of Northern California on the margins of the Second Energy Security Dialogue in Palo Alto last October. This private input is critical. Silicon Valley is often criticized of hubris in its ambition to change the world. Faced with the seemingly insurmountable challenges of ensuring energy supply and slowing climate change, extreme hubris may be exactly what the world needs.

When John Podesta and METI Minister Ken Saito met in April to kick off the new high level energy dialogue, they called for “policies and incentives” that would promote the role of startups as leaders of innovation in the area of clean energy technology.” Hopefully that effort will include a Track 1.5 dialogue that incudes government, big business, startup founders, venture capitalists and academics, along the lines pioneered by the Hoover Center and the Japan Society of Northern California on the margins of the Second Energy Security Dialogue in Palo Alto last October. This private input is critical. Silicon Valley is often criticized of hubris in its ambition to change the world. Faced with the seemingly insurmountable challenges of ensuring energy supply and slowing climate change, extreme hubris may be exactly what the world needs.